**The comparison rate of 11.90% p.a. is based on a secured loan of $30,000 for a term of 5 years. The interest rate is for secured loans only. WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate**

Fixed interest rate of 10.64% p.a. is available on a secured consumer loan agreement for 47 months with a lump sum payment of the loan payable with the last monthly payment.

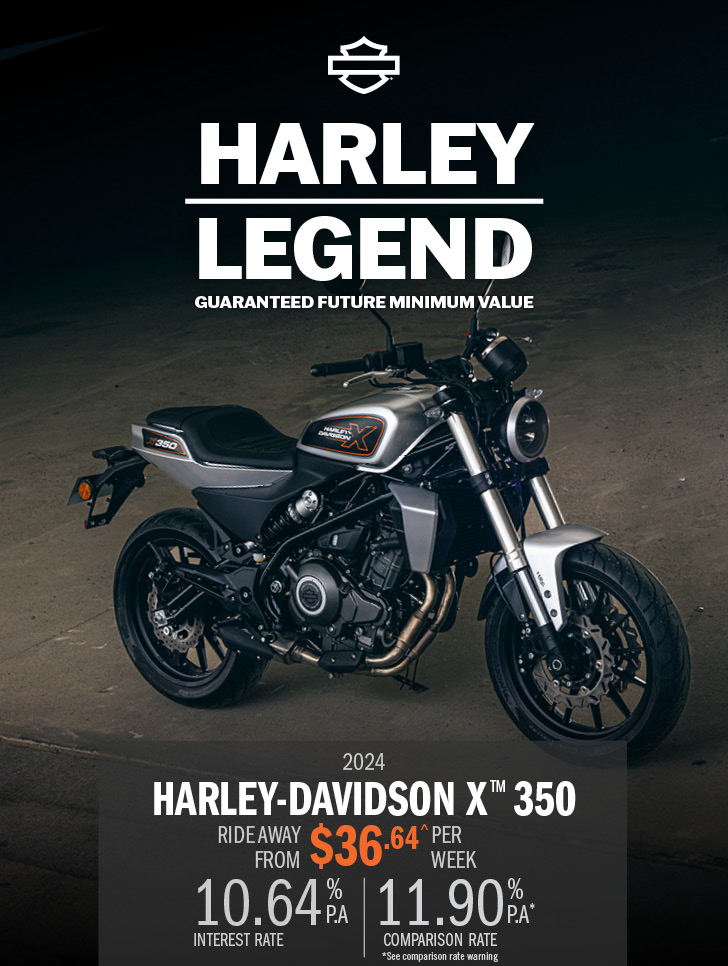

- MY24 Harley-Davidson X™350 estimated weekly repayments of $36.64 is based on a ride away price of $8,495 with a $1,000 deposit financed over 47 months with a fixed interest rate of 10.64% P.A. and a final balloon of $4,842.15 payable at the end of the loan term.

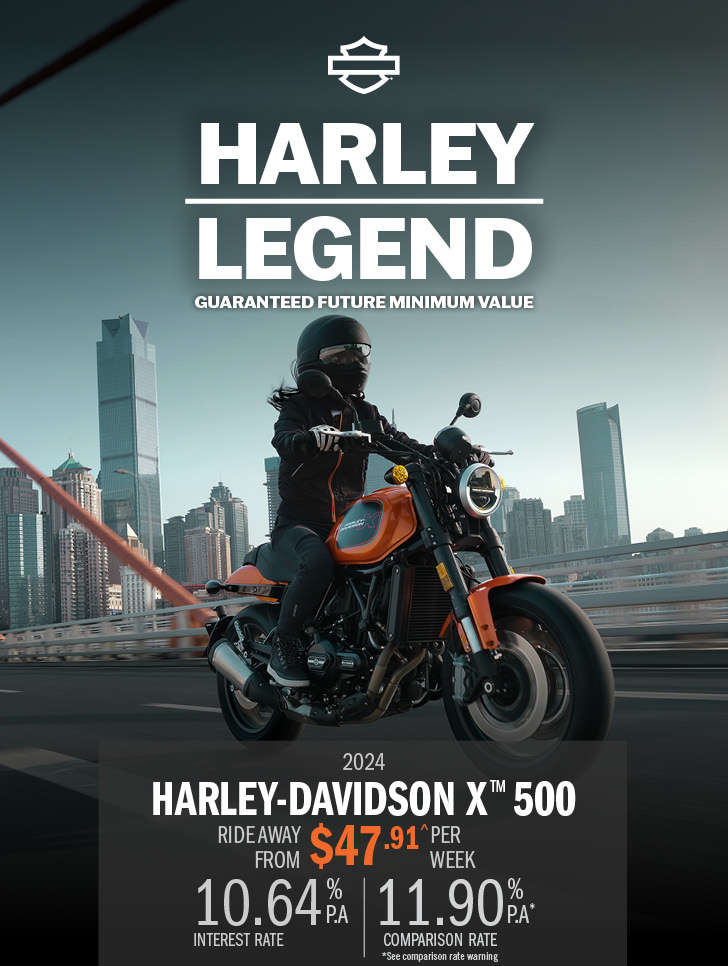

- MY24 Harley-Davidson X™500 estimated weekly repayments of $47.91 is based on a ride away price of $11,495 with a $1,000 deposit financed over 47 months with a fixed interest rate of 10.64% P.A. and a final balloon of $6,552.15 payable at the end of the loan term.

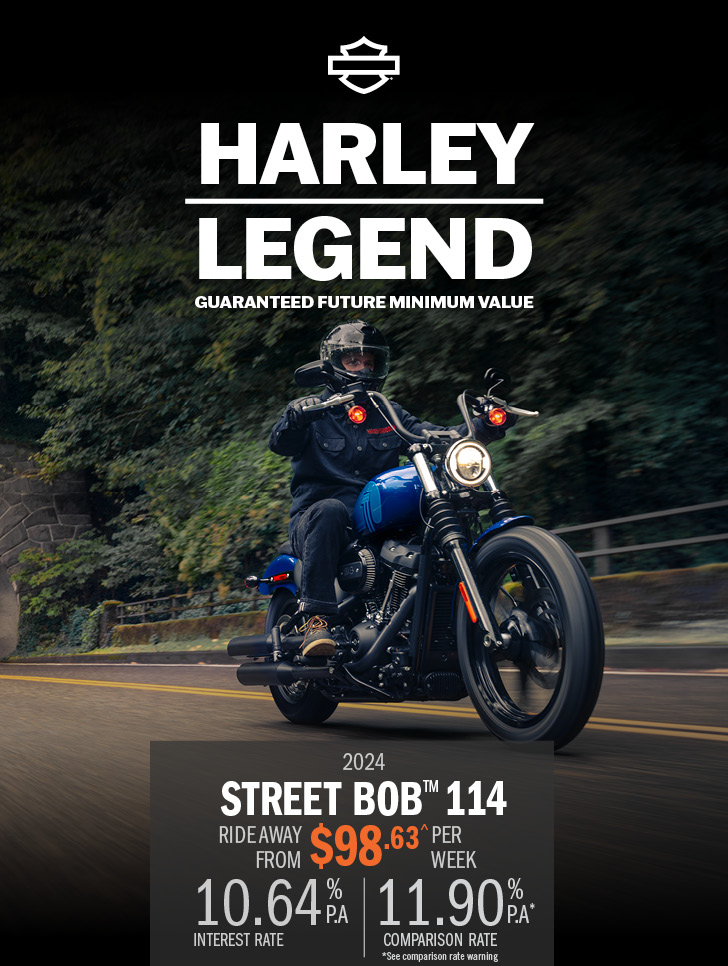

- MY24 Harley-Davidson Street Bob™ 114 estimated weekly repayments of $98.63 is based on a ride away price of $24,995 with a $1,000 deposit financed over 47 months with a fixed interest rate of 10.64% P.A. and a final balloon of $14,247.15 payable at the end of the loan term.

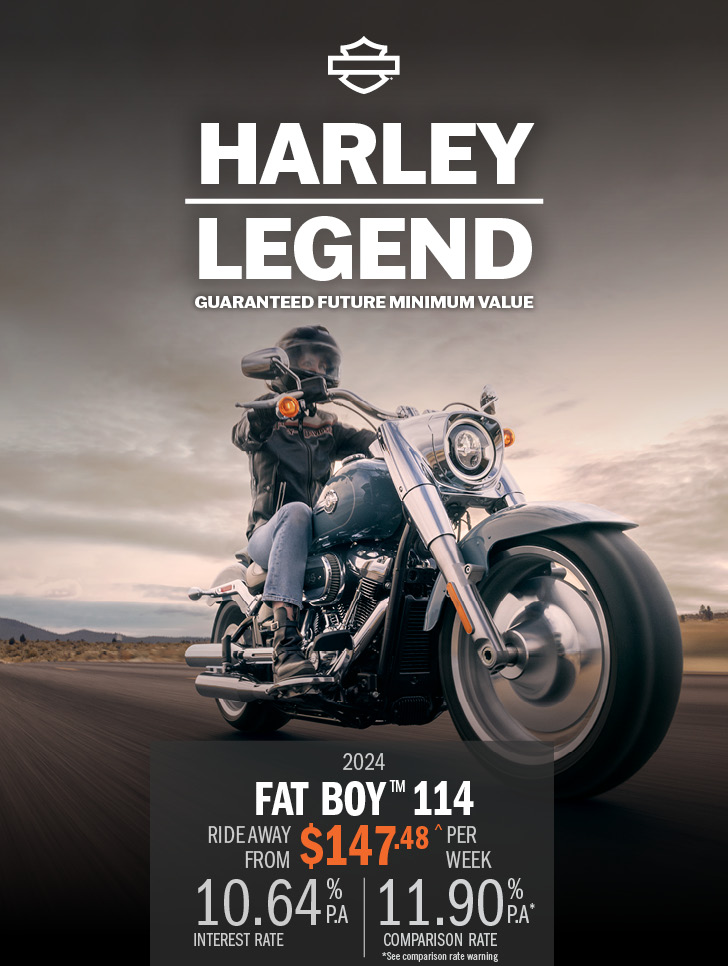

- MY24 Harley-Davidson Fat Boy™ 114 estimated weekly repayments of $147.48 is based on a ride away price of $37,995 with a $1,000 deposit financed over 47 months with a fixed interest rate of 10.64% P.A. and a final balloon of $21,657 payable at the end of the loan term.

- 24 Harley-Davidson Fat Boy™ 114 estimated weekly repayments of $147.48 is based on a ride away price of $37,995 with a $1,000 deposit financed over 47 months with a fixed interest rate of 10.64% P.A. and a final balloon of $21,657 payable at the end of the loan term.

- MY24 Harley-Davidson Fat Boy™ 114 estimated weekly repayments of $147.48 is based on a ride away price of $37,995 with a $1,000 deposit financed over 47 months with a fixed interest rate of 10.64% P.A. and a final balloon of $21,657 payable at the end of the loan term.

- MY24 Harley-Davidson Breakout™ 117 estimated weekly repayments of $147.48 is based on a ride away price of $37,995 with a $1,000 deposit financed over 47 months with a fixed interest rate of 10.64% P.A. and a final balloon of $21,657 payable at the end of the loan term.

- MY24 Harley-Davidson Street Glide™ or Road Glide™ estimated weekly repayments of $179.10 is based on a ride away price of $46,495 with a $1,000 deposit financed over 47 months with a fixed interest rate of 10.64% P.A. and a final balloon of $26,502.15 payable at the end of the loan term.

- MY24 Road Glide™ Limited estimated weekly repayments of $184.13 is based on a ride away price of $47,750 with a $1,000 deposit financed over 47 months with a fixed interest rate of 10.64% P.A. and a final balloon of $27,217.50 payable at the end of the loan term.

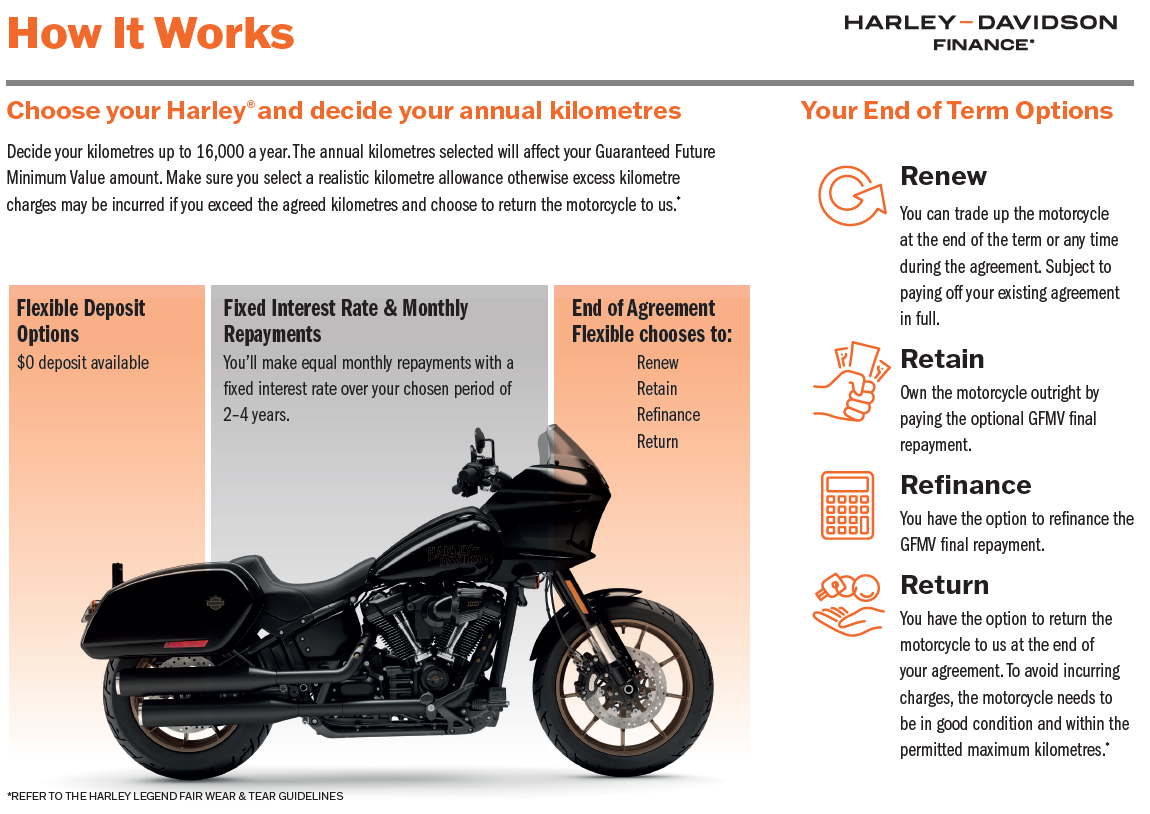

Final balloon lump-sum repayment applies to Harley Legend, which is payable at the end of the loan term. If you choose the Guaranteed Future Minimum Value option, then at the end of the term you may sell the motorcycle to us instead of paying the final balloon lump-sum repayment, provided the motorcycle is maintained in accordance with our Fair Wear and Tear Guidelines as determined by our approved service centre and the contracted kilometre allowance has not been exceeded. The final balloon lump-sum repayment is not a representation of the anticipated market value of the motorcycle at the end of the contract term. For more information go to https://www.harley-davidson.com/au/en/tools/h-d-financial-services.html

Offer available on listed new Harley-Davidson models except CVO & Trikes that are purchased.

BOQC’s standard credit assessment criteria apply. Fees and charges are payable.

Credit provided by BOQ Credit Pty Limited ABN 92 080 151 266 (BOQC) (Australian Credit License Number 393331). BOQC is a wholly owned subsidiary of Bank of Queensland Limited ABN 32 009 656 740 (BOQ). BOQ does not guarantee or otherwise support the obligations or performance of BOQC or the products it offers.